The Complete EDI Test Automation Framework: How to Cut Manual Validation Time by 95% While Ensuring Bulletproof Data Accuracy in 2025

When your latest EDI transaction fails at 3 AM because of a missing segment validation, the cost isn't just a few hours of debugging. Manual EDI testing can take hours or even days for a single workflow, while your trading partners wait and operational costs mount. As EDI specifications are complex, manual testing is quite error-prone as well as time-consuming. The growing volume of EDI slows down the validation process.

The Hidden Cost Crisis of Manual EDI Testing

Healthcare organizations processing thousands of X12 837 claims daily know this pain intimately. Healthcare EDI documents adhere to rigid formats, such as X12 837 (claims) or 835 (remittance advice). Each file includes nested segments, loops, and specific codes. Even minor formatting errors can cause the entire transaction to fail. A single misplaced element can reject an entire batch worth tens of thousands of dollars in claims.

The numbers are staggering. Calculated positive ROI gains within months after the start of a testing engagement become possible when you move from manual validation to automated frameworks. Consider this: if your EDI team spends 40 hours weekly on manual validation tasks, that's $2,000 in labor costs alone (assuming $50/hour). Scale that across quarterly trading partner updates, seasonal volume spikes, and compliance audits, and you're looking at $100,000+ annually just in validation overhead.

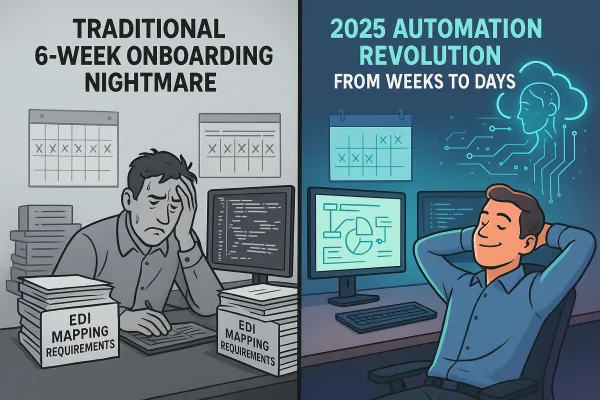

Why Traditional Testing Methods Are Failing in 2025

Traditional EDI testing approaches can't keep pace with modern supply chain demands. The latest trends in EDI testing in 2025 reflect the changing technology and business needs. AI and ML are being leveraged to enhance EDI testing processes, making them more efficient. Your suppliers expect real-time acknowledgments, your ERP system needs instant updates, and compliance requirements change quarterly.

Manual testing creates bottlenecks everywhere. Testing a complex 850 purchase order mapping against your ERP might take a senior EDI analyst 4-6 hours. Multiply that by 50+ trading partners, each with unique requirements, and you're drowning in validation backlogs. EDI transactions are used to exchange data more often than not, they have become an integral part of the business processes and stay the preferred means of communication since the need for automation has become a must. Automation can alleviate the challenges of EDI in terms of complexity, volume, and accuracy.

The AI-Powered EDI Test Automation Revolution

These tools offer functionalities for automating the testing of EDI formats and transaction workflows, thus enhancing the efficiency and accuracy of tests. Leading providers like IBM Sterling, Cleo, and TrueCommerce are integrating machine learning algorithms that predict common mapping errors before they occur. Real-time monitoring and analytics tools are integrated into EDI testing frameworks. These tools provide immediate insights into the performance and functionality of EDI processes, allowing for quick issue identification and resolution.

Modern TMS platforms including Cargoson, MercuryGate, and Descartes are building these validation capabilities directly into their systems. Instead of manual verification of ASN and invoice matches, automated validation rules run continuously, flagging discrepancies within seconds of data receipt.

The technology has matured beyond simple schema validation. This is where the need for an automated system to replace manual validation activities becomes apparent. Automation can significantly reduce the time and resources spent on validation, enhancing its accuracy and efficiency. Advanced frameworks now include predictive error detection, automated exception handling, and self-healing script capabilities that adapt to trading partner changes without manual intervention.

Building Your EDI Test Automation Framework - The 7-Step Blueprint

Here's your roadmap to 95% reduction in manual validation time:

Step 1: Inventory and Prioritize Your EDI Transactions

Start with high-volume, high-value transactions. If you process 10,000 invoices monthly versus 100 advance ship notices, automate invoice validation first. Automating high-value, repeatable scenarios, such as integration, regression, and smoke tests, offers a stronger ROI than covering something like edge cases or low-impact flows.

Step 2: Establish Your Test Data Foundation

Build comprehensive test datasets covering positive scenarios (valid transactions), negative scenarios (intentional errors), and edge cases (maximum field lengths, special characters). Create test cases that cover all the different types of data that can be exchanged. This will help ensure that our automation scripts can handle all possible scenarios.

Step 3: Implement Schema and Structure Validation

Deploy automated schema validation for all incoming and outgoing transactions. We utilize automated schema validation and customized test cases to verify the structure, field values, and sequence of segments. Our QA engineers are trained to handle the unique formatting rules of X12 and HL7 standards. This catches 80% of common EDI errors before they reach business logic.

Step 4: Build Content Validation Rules

Create automated checks for business rules: quantity limits, pricing validations, customer-specific requirements. For example, if Customer A requires PO numbers starting with "CA-", automate that validation rather than manual review.

Step 5: Integration Testing Automation

Automate end-to-end testing from EDI receipt through ERP posting. End to End testing of both the GUI frontend and the API backend of EDI applications along with database verification testing is required. This ensures data integrity across your entire technology stack.

Step 6: Exception Handling and Reporting

Build intelligent error reporting that provides actionable insights, not just "validation failed" messages. Include automated alerts to relevant stakeholders and suggested remediation steps.

Step 7: Continuous Monitoring and Self-Healing

Implement monitoring that detects when trading partners change their formats and automatically updates validation rules. Ensure your automation system is robust enough to withstand the release of new versions. Unlike other systems, testRigor does not rely on the detailed specifics of the implementation. This results in unparalleled stability, saving countless hours each week.

Essential Testing Types and Validation Layers

Your automation framework needs multiple validation layers working in concert. Unit-level validation checks individual segments and elements. Transaction-level validation ensures proper loops and hierarchies. Business-level validation enforces your specific rules and requirements.

Focus on automated regression testing for every change. When UPS updates their 214 shipment status format, your automation should catch mapping issues before they impact operations. Automated tests are particularly effective in regression testing, where repeated test cases need to be executed with every code change.

ROI Analysis: The Business Case for EDI Test Automation

The numbers don't lie. According to a report by Capgemini, test automation can reduce testing time by up to 40% and testing effort by up to 60%. This can result in significant cost savings, particularly for large and complex software projects. For EDI specifically, organizations report even higher efficiency gains because of the repetitive nature of validation tasks.

Real case studies show dramatic improvements. A study by Symtrax found that businesses achieve an average ROI of 240%, typically recouping their investment within six to nine months after deployment. One healthcare payer reduced EDI validation time from 4 hours per batch to 15 minutes, enabling same-day claims processing that improved cash flow by millions.

A survey by Capgemini found that organizations using test automation achieved a 30% reduction in time-to-market and a 25% increase in test coverage. Furthermore, the survey highlighted that 70% of these organizations experienced a positive ROI in test automation within the first year. The compound benefits accelerate over time as your automation coverage expands.

Cost breakdown for a mid-sized operation processing 100,000 EDI transactions monthly:

- Manual validation: 200 hours/month × $65/hour = $13,000 monthly

- Automation framework: $50,000 initial investment + $3,000 monthly maintenance

- Break-even: 5 months

- Year 1 savings: $106,000

Advanced Automation Strategies for Complex Supply Chains

Multi-partner scenarios require sophisticated automation approaches. It also provides an end-to-end solution for EDI testing that mainly involves the generation of mock-up EDI files for performance testing, validation and reporting of EDI data, translation of EDI files to standard formats like JSON, and encryption of sensitive information. Your framework needs to handle Walmart's specific ASN requirements differently from Target's, while maintaining consistency in your internal processing.

Volume testing becomes critical during peak seasons. Automate load testing that simulates Black Friday transaction volumes or year-end inventory adjustments. Automating tests can dramatically reduce the amount of time needed to test EDI files. Increased accuracy: Automated tests are less likely to introduce errors than manual testing. Improved efficiency: Automated tests can be run more frequently than manual tests

Integration with Modern TMS and ERP Systems

Leading transport management systems are embracing automation-first approaches. Cargoson, Transporeon, and nShift offer APIs that enable real-time validation feedback, eliminating the traditional batch-and-pray approach to EDI testing.

ERP integration testing requires automated validation of data transformations. When your 810 invoice becomes an accounts payable entry in SAP, automation ensures field mapping accuracy, tax calculations, and proper account coding. As businesses collaborate with multiple partners, interoperability testing ensures that EDI systems can seamlessly exchange data with diverse systems. This trend highlights the importance of compatibility and standardization in EDI testing.

API-EDI hybrid approaches need specialized testing. Your automation framework should validate both traditional X12 transactions and modern JSON API calls, ensuring data consistency regardless of the communication method.

Future-Proofing Your EDI Testing Strategy for 2025 and Beyond

Blockchain technology is being explored to enhance the transparency, security, and immutability of EDI transactions. Your testing framework needs flexibility to adapt to emerging technologies while maintaining backward compatibility with legacy systems.

Security testing automation becomes increasingly important as cyber threats target supply chain communications. Automated validation of encryption, digital signatures, and access controls protects against data breaches that could cost millions in fines and reputation damage.

Real-time data exchange requirements are pushing EDI beyond traditional batch processing. There is a growing trend towards comprehensive test automation in EDI testing. Automated test scripts are being developed to cover many test cases, reducing manual effort and minimizing human error. Your automation strategy needs to accommodate instant acknowledgments, real-time inventory updates, and immediate payment confirmations.

The investment in comprehensive EDI test automation pays dividends far beyond reduced manual testing time. Automation shrinks test cycles from days to hours, enabling quicker regression testing, faster builds, and more frequent releases. CI/CD pipelines integrated with automation tools enable continuous testing and provide immediate feedback, thereby reducing the time spent waiting between development and QA. You gain predictable data flows, stronger trading partner relationships, and the agility to adapt to changing business requirements.

Start with your highest-impact transactions, build incrementally, and measure everything. Your 95% reduction in manual validation time isn't just a efficiency gain, it's a competitive advantage that compounds quarterly as your supply chain complexity grows.